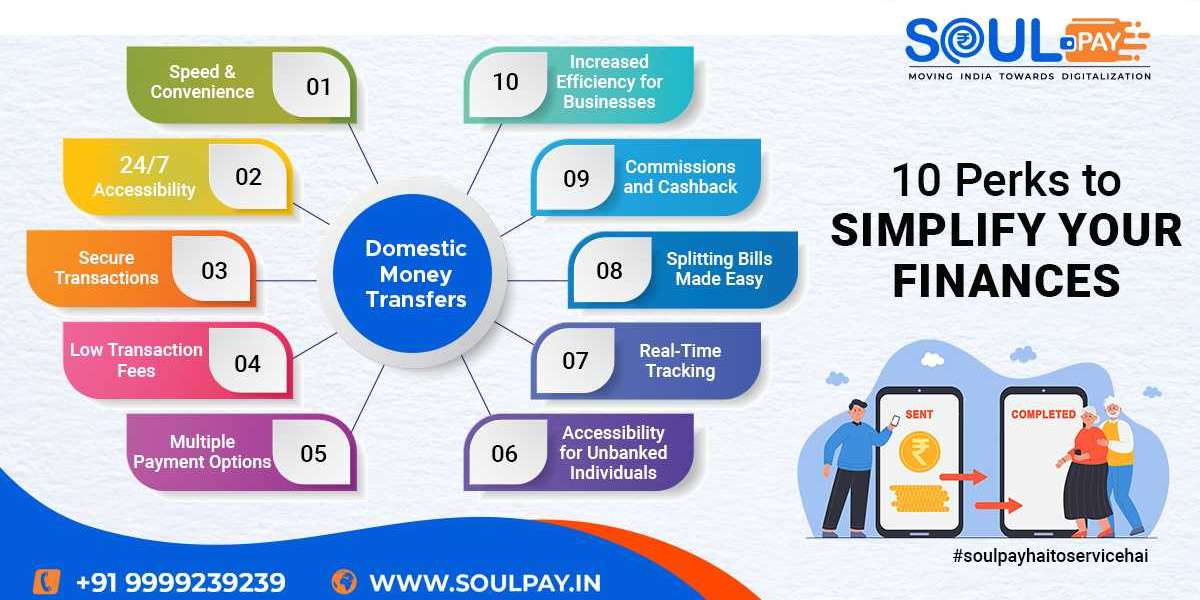

Welcome to the digital era, when you can send money, make payments on your bills, and manage your finances at your fingertips. The days of tedious paperwork and drawn-out lines are a thing of the past thanks to the astounding growth of online money transfer services. We set out on a journey today to explore the plethora of benefits that domestic money transfer services provide you with ease, effectiveness, and a stress-free financial existence. So sit back as we explore the top ten advantages of using these ground-breaking services.

Benefits that Domestic Money Transfer Services

1. Speed and Convenience

Long bank lines and days spent waiting for checks to clear are things of the past. With the aid of domestic money transfer services, sending money to anyone in the nation using a computer or smartphone is simple and quick. You can focus on more important elements of your life with this level of speed and convenience, which saves you a lot of time.

2. 24/7 Accessibility

Online money transfer services are available 24/7, allowing you to conduct transactions at any hour of the day or night. These services make sure you always have full access to your funds, regardless of whether you need them for a last-minute bill payment or an urgent financial concern.

3. Secure Transactions

Modern domestic money transfer providers use strong encryption and security procedures to safeguard your financial data. You can have peace of mind knowing that all of your transactions are secure and that no one will ever learn your personal information.

4. Low Transaction Fees

Online platforms have many benefits over conventional banking techniques when it comes to money transfer services. The fact that internet services often charge reduced transaction costs and offer more transparent pricing is one major advantage. As a result, you can send money without worrying about high fees draining your cash.

5. Multiple Payment Options

Bank transfers, credit/debit cards, and digital wallets are just a few of the many payment methods that domestic money transfer providers accept. Due to your ability to select the best approach for you, transactions are more seamless and personalized.

6. Accessibility for Unbanked Individuals

For individuals who don’t have access to traditional banking services, the online money transfer services of SOULPAY can be a game-changer. They can receive and send money without needing a bank account, promoting financial inclusion for all.

7. Real-Time Tracking

Say goodbye to uncertainty and waiting anxiously for money to reach its destination. With online money transfer services, you can track your transactions in real time, ensuring you stay updated on the status of your funds.

8. Splitting Bills Made Easy

Splitting bills can often be a complicated and tedious task, but with domestic money transfer services, it has become much easier and hassle-free. Whether you’re living with roommates, planning a group event, or managing finances within your family, these services provide a convenient solution to divide expenses effortlessly.

You no longer need to go through the hassle of collecting and handling cash from everyone involved. Instead, you can rely on digital platforms or mobile applications to split the bills efficiently. This simplifies the entire process and reduces the stress associated with managing shared expenses.

With domestic money transfer services, you can easily track who owes what and send or receive payments with just a few clicks. This not only saves time but also eliminates the need for complex calculations or disputes over who paid for what. The transparency and convenience offered by these services make managing shared expenses a breeze.

9. Commissions and Cashback

Many online money transfer services provide exciting commissions and cashback rewards, making transactions even more cost-effective. By taking advantage of these incentives, you can save money while managing your finances.

10. Increased Efficiency for Businesses

Domestic money transfer services offer significant advantages to businesses, particularly in terms of increased efficiency. These services provide a seamless and convenient platform for making payments to vendors, suppliers, and employees, thereby streamlining financial operations and enhancing overall productivity.

By utilizing domestic money transfer services, businesses can simplify their payment processes. Instead of dealing with traditional methods like writing checks or handling cash, they can leverage digital platforms or mobile applications to initiate transactions swiftly and securely. This eliminates the need for manual paperwork and reduces the chances of errors or delays in payment processing.

Final Thoughts

Online domestic money transfer services offer numerous advantages that enhance the way we handle finances and interact with money. From convenience and security to lower fees and environmental benefits, these services empower us to manage our funds efficiently and effectively. So, why wait? Get in touch with the INDIA’S leading platform, SOULPAY, which is the future of finance, and experience the countless benefits of domestic money transfer services.

Get ready to experience the convenience and efficiency of online domestic money transfer services. Sign up now and take the first step toward a seamless financial journey. Start sending money, paying bills, and managing your finances with ease!