In the United Arab Emirates, navigating the world of business involves understanding and adhering to the country's tax regulations. A crucial aspect of this is the TRN number UAE, or Tax Registration Number. This unique 15-digit identifier is issued by the Federal Tax Authority (FTA) to businesses and individuals registered for Value Added Tax (VAT). Think of it as your official tax identity within the UAE.

The TRN number UAE serves as a vital link between your business and the tax authorities. It's essential for various tax-related transactions, including filing VAT returns, issuing tax invoices, and making tax payments. Without a valid TRN, businesses cannot legally operate within the UAE's VAT framework.

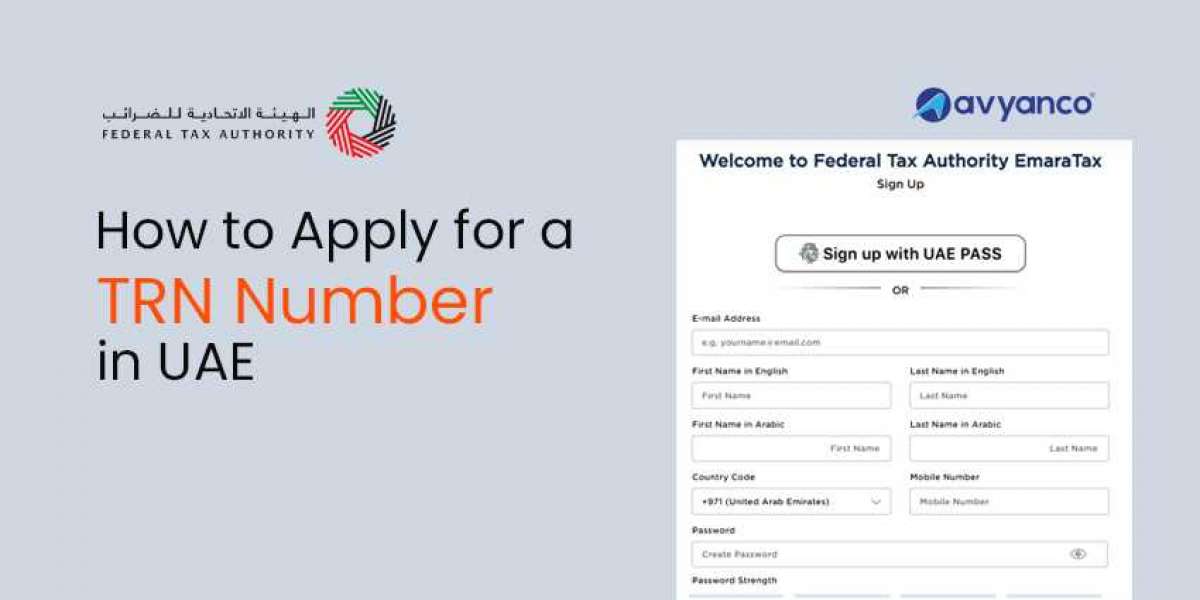

Obtaining a TRN number UAE is a mandatory step for businesses exceeding the VAT registration threshold or voluntarily registering for VAT. The application process involves submitting relevant documents to the FTA and meeting specific criteria. Once approved, businesses are assigned a unique TRN that must be included on all tax-related documents.

Maintaining accurate records related to your TRN number UAE is crucial for ensuring compliance with tax laws and avoiding potential penalties. It's advisable to consult with tax professionals to understand the specific requirements and ensure your business is fully compliant with all relevant regulations.