Industrial Lasers Systems Industry

Summary:

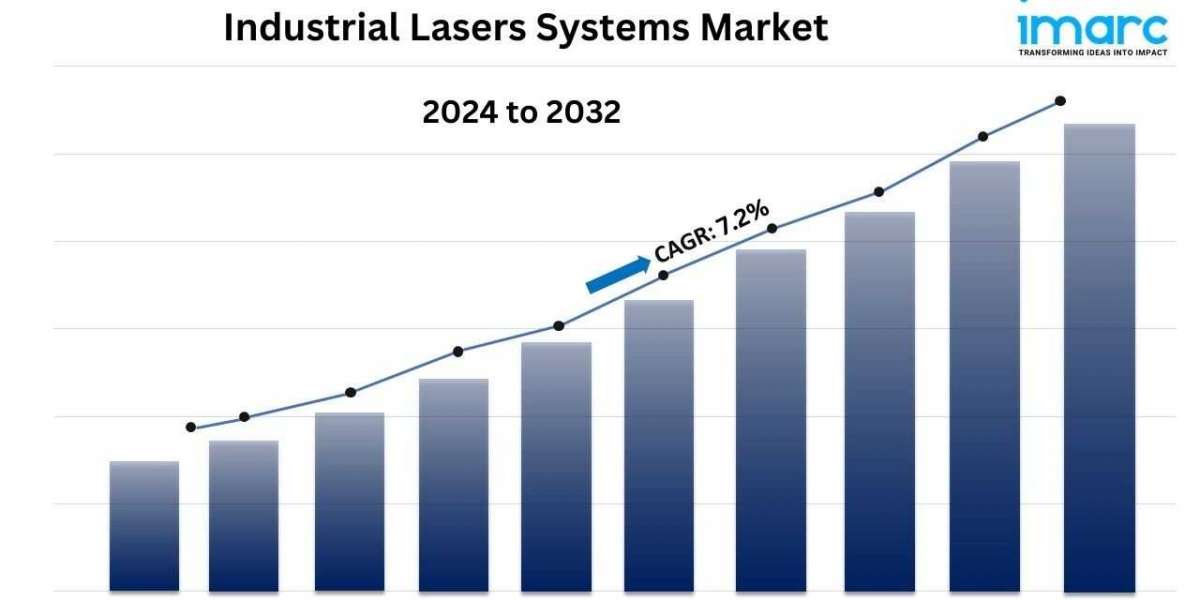

- The global industrial lasers systems market size reached USD 21.4 Billion in 2023.

- The market is expected to reach USD 40.4 Billion by 2032, exhibiting a growth rate (CAGR) of 7.2% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest industrial lasers systems market share.

- Fiber lasers accounts for the majority of the market share in the type segment due to their superior efficiency, high beam quality, and versatility across various industrial applications, which make them more cost-effective and reliable compared to other laser technologies.

- Cutting holds the largest share in the industrial lasers systems industry.

- Semiconductor and electronics sector remain a dominant segment in the market, as it demands high-precision laser systems for the production of increasingly complex and miniaturized electronic components and devices.

- The increasing focus on automation and industry 4.0 is a primary driver of the industrial lasers systems market.

- Growing need for precision manufacturing and rising investment in research and development (RD) are reshaping the industrial lasers systems market.

Industry Trends and Drivers:

- Significant technological advancements:

Technological advancements are a significant driver of the global industrial lasers systems market. Recent innovations have significantly enhanced the performance, efficiency, and capabilities of laser systems. The development of high-power fiber lasers, for instance, has revolutionized the industry by offering greater precision and cutting speed while reducing operational costs. These lasers are more efficient and have a longer lifespan compared to traditional gas lasers, making them ideal for applications in cutting, welding, and material processing. Moreover, the integration of advanced control systems and software has improved the functionality and ease of use of laser systems. Automation and digitalization have enabled more precise control of laser parameters, enhanced the quality of outputs and reduced human error. Additionally, the development of adaptive optics and beam shaping technologies allows for more versatile applications across various industries, including automotive, aerospace, and electronics.

- Increasing demand from end-use industries:

The rising demand for industrial laser systems is closely linked to their applications across diverse end-use industries. In the automotive sector, lasers are used for cutting and welding metal components, producing high-quality parts with minimal waste. As the automotive industry evolves with advancements in electric vehicles and lightweight materials, the need for precise and efficient laser systems increases. In the aerospace industry, lasers are essential for the manufacturing of high-precision components and assemblies. The need for lightweight, durable materials in aerospace applications drives demand for advanced laser systems capable of handling complex materials and geometries. Similarly, the electronics industry relies on lasers for tasks such as micromachining and surface structuring, which are crucial for producing components with fine tolerances and high performance. The growing trend of customization and miniaturization in consumer electronics also contributes to the increasing demand for industrial laser systems.

- Rising adoption of laser technology in emerging markets:

The adoption of laser technology is expanding rapidly in emerging markets, contributing significantly to the growth of the global industrial lasers systems market. Countries in Asia-Pacific, Latin America, and the Middle East are experiencing robust industrialization and infrastructure development, leading to increased investments in advanced manufacturing technologies, including lasers. In Asia-Pacific, countries such as China and India are witnessing rapid industrial growth and technological advancements. The rise of manufacturing hubs and the expansion of industries such as automotive, electronics, and aerospace in these regions are driving demand for laser systems. Additionally, government initiatives aimed at boosting technology adoption and modernization of industrial processes further support this growth. In Latin America and the Middle East, economic development and increasing industrial activities are creating new opportunities for laser technology. As these regions invest in advanced manufacturing processes to enhance productivity and competitiveness, the adoption of industrial laser systems is expected to rise.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/industrial-lasers-systems-market/requestsample

Industrial Lasers Systems Market Report Segmentation:

Breakup By Type:

- Fiber Laser

- Solid State Laser

- CO2 Laser

- Others

Fiber laser dominate the market due to their superior performance, efficiency, and versatility in applications such as cutting, welding, and marking, which make them highly desirable for various industrial uses.

Breakup By Application:

- Cutting

- Welding

- Marking

- Drilling

- Others

Cutting holds the maximum number of shares due to its widespread use across various industries for precise and efficient processing of materials, ranging from metals to plastics.

Breakup By End Use Industry:

- Semiconductor and Electronics

- Automotive

- Aerospace and Defense

- Medical

- Others

Semiconductor and electronics sector represents the largest segment due to its high demand for advanced laser systems used in precise microprocessing and manufacturing of intricate electronic components.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position owing to a large market for industrial lasers systems driven by its rapid industrialization, robust manufacturing base, and significant investments in advanced technologies across countries such as China, Japan, and India.

Top Industrial Lasers Systems Market Leaders:

- ACSYS Lasertechnik US Inc.

- Amonics Ltd.

- Coherent Inc.

- Han's Laser Technology Industry Group Co. Ltd

- II-VI Incorporated

- IPG Photonics Corporation

- Jenoptik Laser GmbH

- Lumibird Group

- Newport Corporation (MKS Instruments Inc.)

- NKT Photonics A/S

- Toptica Photonics AG

- TRUMPF

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.