The tokenization market is experiencing unprecedented growth and is poised to revolutionize a wide array of industries. Tokenization is a sophisticated process that converts sensitive data—such as payment information, personal identification numbers, and confidential records—into unique tokens.

This innovative technology has gained substantial traction across sectors, primarily due to escalating concerns over data breaches and cybersecurity threats. As organizations increasingly face the risk of unauthorized access to sensitive data, tokenization emerges as a robust solution. By substituting sensitive information, like credit card numbers or social security numbers, with non-sensitive tokens, businesses can effectively minimize their vulnerability to malicious attacks

In the financial sector, the advantages of tokenization become even more pronounced. The ability to tokenize physical assets, including real estate, art, and stocks, allows for fractional ownership, enabling a broader range of investors to participate in opportunities that were traditionally limited to high-net-worth individuals. This democratization of investment not only opens new avenues for revenue generation but also enhances liquidity in markets that have historically been illiquid. For instance, tokenized assets can be traded on digital platforms, facilitating quicker transactions without the delays associated with conventional processes.

Moreover, tokenization simplifies and accelerates cross-border transactions by eliminating the need for intermediaries such as banks and payment processors. This streamlining results in lower transaction costs and faster processing times, making it an attractive option for businesses operating on a global scale. In conclusion, the tokenization market is not just a passing trend; it represents a fundamental shift towards more secure, efficient, and accessible transactions across various sectors, paving the way for innovative applications and investment strategies in the future.

The report begins with an outline of the business environment and then explains the commercial summary of the chain structure.

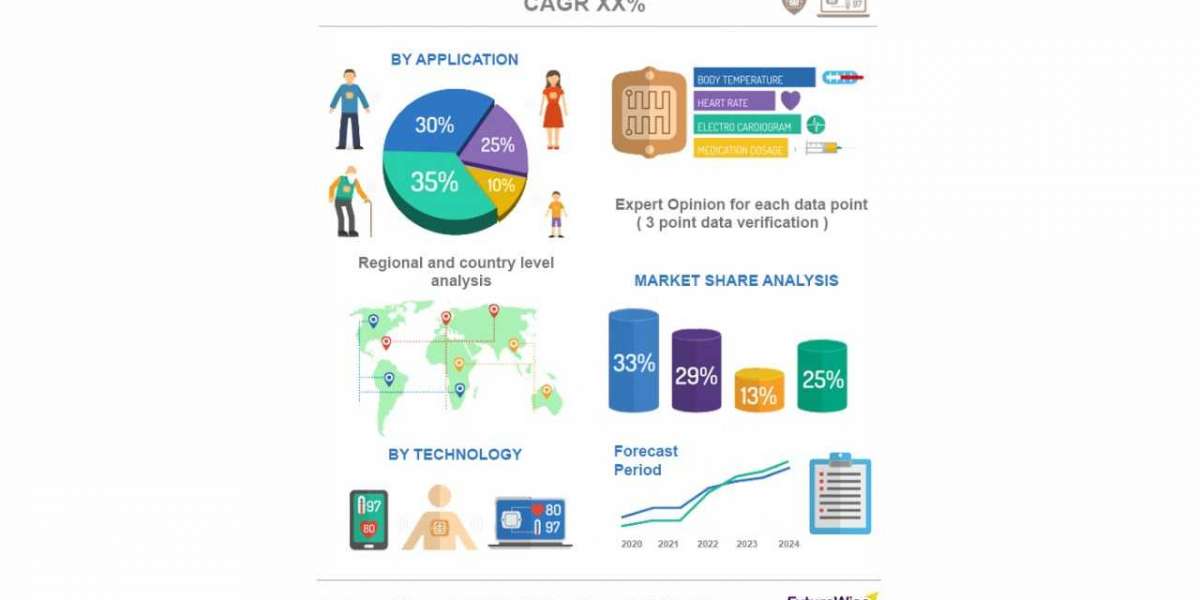

The report also includes data on the overview of the competitive situation among different companies, including an analysis of the current market situation and prospects for growth. This report provides insights on the general market's profit through graphs, an in-depth SWOT analysis of the trends in this business space alongside regional proliferation.

Full Report @ https://futuremarketanalytics.com/report/tokenization-market/

Tokenization Market Segmentation:

By Component

- Solutions

- Services

By Services

- Professional Services

- Managed Services

By Application Area

- Payment Security

- User Authentication

- Compliance Management

By Tokenization Technique

- API-Based

- Gateway-Based

By Deployment Mode

- On-premises

- Cloud

By Organization Size

- SMEs

- Large enterprises

By Verticals

- BFSI

- Healthcare

- IT and ITES

- Government

- Retail and eCommerce

- Energy and Utilities

- Others (Telecom, Travel and Hospitality, Manufacturing, and Media and Entertainment)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Competitive Landscape in the Tokenization Market:

Major market players enclosed within this market are

- Fiserv

- Mastercard

- Visa

- Micro Focus

- American Express

- Helpsystems

- Meawallet

- Thales Trusted Cyber Technologies

- Ciphercloud

- Futurex

- Tokenex

- nCipher

- Verifone

- Bluefin Payment Systems

- Marqeta

- Paragon Payment Solutions

- Integrapay

- Asiapay Technology

- Liaison Technologies

- Ingenico Epayments

(Note: The lists of the key players are going to be updated with the most recent market scenario and trends)

Future Market Analytics Focus Points:

- SWOT Analysis

- Key Market Trends

- Key Data -Points Affecting Market Growth

- Revenue and Forecast Analysis

- Growth Opportunities for New Entrants and Emerging Players

- Key Player and Market Growth Matrix

Objectives of the Study:

- To provide a comprehensive analysis on the Tokenization Market By Component,By Services,By Application Area ,By Tokenization Technique ,By Deployment Mode ,By Organization Size,By Verticals and By Region

- To cater extensive insights on factors influencing the market growth (drivers, restraints, industry-specific restraints, business expansion opportunities)

- To anticipate and analyse the market size expansion in key regions- North America, Europe, Asia Pacific, Latin America and Middle East and Africa

- To record and evaluate competitive landscape mapping- strategic alliances and mergers, technological advancements and product launches, revenue and financial analysis of key market players

Flexible Delivery Model:

- We have a flexible delivery model and you can suggest changes in the scope/table of content as per your requirement

- The customization services offered are free of charge with purchase of any license of the report.

- You can directly share your requirements/changes to the current table of content to: [email protected]

About Future Market Analytics:

We at Future Market Analytics are capable of understanding consumer and market mindsets. Based on a precise current and forecast data analysis, we offer the most pertinent insights to organizations by implementing the latest market research methodologies. Studying high-growth niche markets like shipping and transportation, blockchain, energy, and sustainability, providing customized solutions to our clients, assuring agility, and flexibility in report delivery are parts of our business model which makes us stand out within our competition.